mapeeg.ru

Prices

How To Listen To A Phone Call

The answer is simple: use a call recorder app. In this post, we'll go over the best apps to listen to someone's phone calls. Google's Gemini AI assistant can now listen to your phone calls and let you know in real time if something sounds like a scam. Table Of Contents · 1. Use Phonsee to Listen to Someone Else's Calls Without Them Knowing · 2. Use mSpy to Listen to Cell Phone Calls Remotely · 3. Use Eyezy to. Call intercept is a FlexiSPY feature that allows you to listen in on live phone calls remotely and undetected. And the law does require that most workplace monitoring—listening in on telephone calls and audio-taping or videotaping conversations—must have some legitimate. XNSPY offers a call recording feature that lets you eavesdrop on all (outgoing and incoming) calls. Remotely and discreetly. Try XNSPY for less than $ a. How to Listen to Phone Calls from Another Phone? · 1. Using KidsGuard Pro · 2. Using TapeACall · 3. Using Google Voice · 4. Using NoNotes · 5. Using a Code. Note: This article does not apply to Engage customers. The recordings of inbound and outbound calls are accessible and available for download for monitoring and. Install AnyControl on your target device to start recording phone calls and listen to conversations in your phone. You can download and save the recording files. The answer is simple: use a call recorder app. In this post, we'll go over the best apps to listen to someone's phone calls. Google's Gemini AI assistant can now listen to your phone calls and let you know in real time if something sounds like a scam. Table Of Contents · 1. Use Phonsee to Listen to Someone Else's Calls Without Them Knowing · 2. Use mSpy to Listen to Cell Phone Calls Remotely · 3. Use Eyezy to. Call intercept is a FlexiSPY feature that allows you to listen in on live phone calls remotely and undetected. And the law does require that most workplace monitoring—listening in on telephone calls and audio-taping or videotaping conversations—must have some legitimate. XNSPY offers a call recording feature that lets you eavesdrop on all (outgoing and incoming) calls. Remotely and discreetly. Try XNSPY for less than $ a. How to Listen to Phone Calls from Another Phone? · 1. Using KidsGuard Pro · 2. Using TapeACall · 3. Using Google Voice · 4. Using NoNotes · 5. Using a Code. Note: This article does not apply to Engage customers. The recordings of inbound and outbound calls are accessible and available for download for monitoring and. Install AnyControl on your target device to start recording phone calls and listen to conversations in your phone. You can download and save the recording files.

Advanced application KidLogger v. for Android OS has new feature - calls recording. All these conversations are stored in Voice Records Analytics and you. Silent Monitoring. CSD allows a supervisor to silently monitor agent calls. It can be configured whether the agents are aware or unaware that they are being. Download calls and listen to them whenever and wherever you want with the Gong mobile app. Benefit from many of Gong's powerful desktop features. Listen to live calls to improve agent performance, coach new hires, assess call quality and enhance overall call standards. The answer is simple: use a call recorder app. In this post, we'll go over the best apps to listen to someone's phone calls. Call Recorder for iPhone allows you to save any incoming and outgoing call in seconds. Easily turn your phone conversations into handy voice notes for later. Why is my phone listening to me? Your phone and plan carrier use voice data, which can manifest in several forms — from voice assistant apps like Siri and. Listen in and find out what's really happening with AnyControl phone call recorder that secretly gets access to smartphones to record and listen to phone calls. For using conference barge on shared line group members: Zoom desktop client or mobile app, version or higher. For monitoring call queues or shared line. Note: This article does not apply to Engage customers. The recordings of inbound and outbound calls are accessible and available for download for monitoring and. Listen to the phone call from a customer to practise and improve your listening skills. Do the preparation task first. Then listen to the audio and do the. How to Listen to Someone's Phone Calls Without Forwarding (Monitor Phone Calls) Subscribe to How to Simple to get more solutions to your. This feature enables a monitoring party to listen to both sides of a call. It is available on user or station queues and My Interactions, if you have the. There are different methods you can use to listen to your child's phone calls remotely. The most popular method that parents use is using parental control apps. Listen All Calls Without any application. how to listen phone call on your phone. how to Listen all phone call. In this video i will show. Wondering if it is possible listen others call on my phone? With these 5 apps, you can do even more. Read on for the instructions! Your phone may be listening to you through voice assistants and apps that have access to your microphone. Turn them off to stop your phone from listening. Step 1: Ensure you have call recording enabled. Navigate to Settings > Phone Numbers > Edit. Check the call recording box. Click Update to confirm the changes. [ Latest Guide] on how to listen to cell phone conversations from another phone. Learn effective methods and tools to monitor calls secretly. Learn more: mapeeg.ru Your child may get in touch with people you do not approve of.

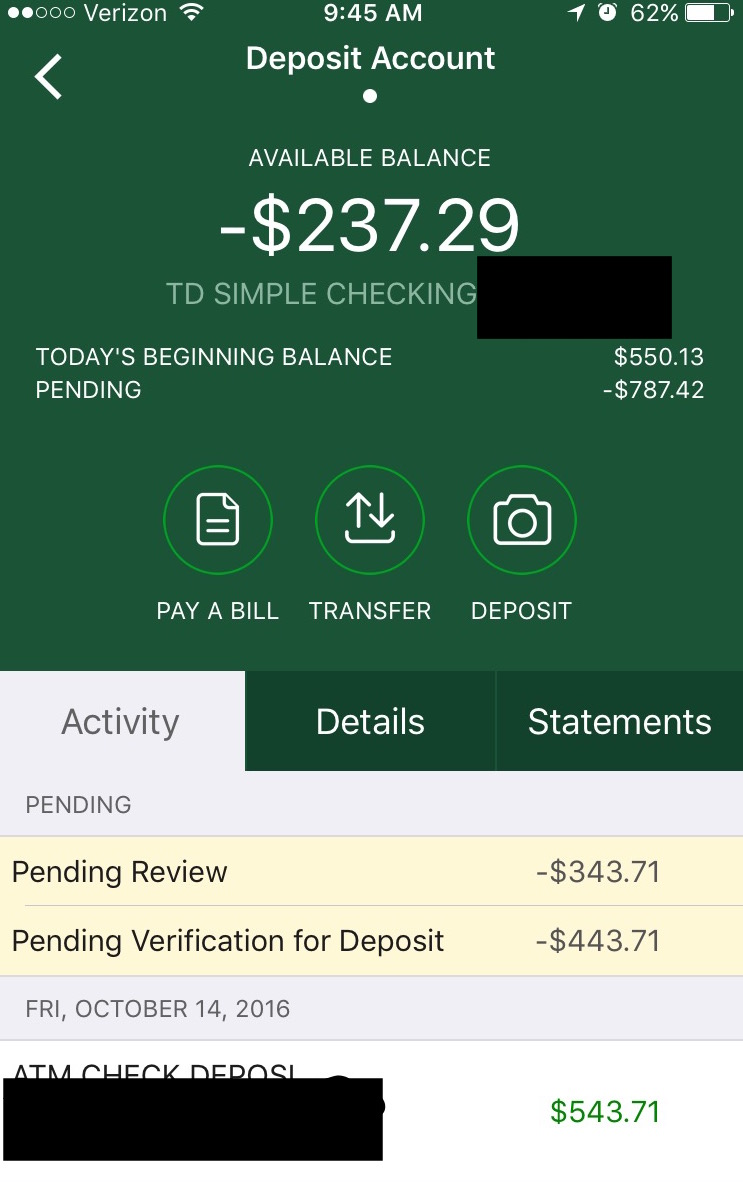

How Long Can My Td Bank Account Be Overdrawn

TD will send you an email officially notifying you that the Grace Period is active, giving you until 11pm to bring your available balance back to $0. How do I close a bank account? If my TD Access Card is lost or stolen, will my account remain safe? Are my TD Canada Trust accounts insured? How do I change. your account can sit at a negative balance for 59 days. At EOD on the 59th day, it will move into a Charge Off. You now owe the bank that. TD Bank will only charge you up to 3 overdraft fees per day. Even if you attempt transactions that would overdraw your account more than 3 times in a day, you. Add money in a snap · Get your paychecks faster. · Deposit checks in a flash with Mobile Deposit1 or drop by your nearest ATM or store. · Find out how soon your. You may still be assessed an Overdraft fee ($35 max of $ per day per account) if the transfer could not be made such as; if there is not enough money in the. Worried about negative bank accounts? With TD Overdraft Relief, no overdraft fee will be charged for $50 or less overdraws. Learn more now! How long does processing deposits take? What are the cut-off Overdrafts can happen if you take money from your account before your checks have cleared. If your available account balance is overdrawn by $5 or less, you will not be charged overdraft-paid, overdraft-return or overdraft protection transfer fees. TD will send you an email officially notifying you that the Grace Period is active, giving you until 11pm to bring your available balance back to $0. How do I close a bank account? If my TD Access Card is lost or stolen, will my account remain safe? Are my TD Canada Trust accounts insured? How do I change. your account can sit at a negative balance for 59 days. At EOD on the 59th day, it will move into a Charge Off. You now owe the bank that. TD Bank will only charge you up to 3 overdraft fees per day. Even if you attempt transactions that would overdraw your account more than 3 times in a day, you. Add money in a snap · Get your paychecks faster. · Deposit checks in a flash with Mobile Deposit1 or drop by your nearest ATM or store. · Find out how soon your. You may still be assessed an Overdraft fee ($35 max of $ per day per account) if the transfer could not be made such as; if there is not enough money in the. Worried about negative bank accounts? With TD Overdraft Relief, no overdraft fee will be charged for $50 or less overdraws. Learn more now! How long does processing deposits take? What are the cut-off Overdrafts can happen if you take money from your account before your checks have cleared. If your available account balance is overdrawn by $5 or less, you will not be charged overdraft-paid, overdraft-return or overdraft protection transfer fees.

Overdrafting my account was the biggest issue for me with mu old Survival money story. YES, YOU CAN OVERDRAFT YOUR BANK ACCOUNT WITHOUT A JOB. original. Your overdraft protection comes into effect automatically – up to your limit, whenever your account is overdrawn. Repaying it is easy too. As soon as you make a. Overdraft fees are $35 per overdrawn amount. You can be charged up to five times in a single day, so if for some reason five different payments get processed. Overdrafting my account was the biggest issue for me with mu old Survival money story. YES, YOU CAN OVERDRAFT YOUR BANK ACCOUNT WITHOUT A JOB. original. For example, we typically do not pay overdrafts if your account is not in good standing, or you are not making regular deposits, or you repeatedly overdraft. Anyone with a TD Bank checking account who has been charged multiple overdraft debit that was not covered they would charge my account with overdrafted fees. In addition to the basic checking account, customers can add online banking How much does it cost to bring a lawsuit against my bank for improper overdraft. Before TD changed its policy, I used to get charged a fee each time no matter the amount overdrafted. It's worth mentioning that TD changed its. Customers can opt out of overdraft policies that allow the bank to cover charges and add an NSF fee, or link at least one backup account, such as a savings. You have an overdraft grace zone¹ of up to $50 with most checking accounts. You can set up account alerts within digital banking² to always keep you in-the-know. With Overdraft Grace, if you overdraw your account by more than $50 but make sufficient deposits to bring your available account balance back to $0 or greater. A $35 fee applies to each transaction that overdraws your available account balance by more than $50, whether that transaction is made by debit card, check, in. Choose or change your overdraft options: · In person. Visit a TD Bank near you. Find a TD Bank · Schedule an appointment. Connect with a Small Business specialist. You can apply to increase your Overdraft Protection limit on your chequing account on Easyweb (single accounts only) to a maximum of $ total on all. Yes. Many transactions are processed overnight. These transactions may not be reflected in an available balance. Refer to your deposit account agreement for. A rejected payment can lead to late fees on your bills, as well as bank charges for non-sufficient funds (NSF). Overdraft Protection helps prevent this. When. you don't pay that overdraft fee. During the first 30 days of no payment, your bank will start calling you, contacting you, trying to get you to pay that. If either you or we close your Account, you must still fulfill your obligations. You will need to pay any money owed to any TD Bank Group member, including any. Overdrafting on your account is a real pain, especially considering overdraft fees can be as much as $ Know how to prevent overdrafts. 2. What's a. Overdrafting on your account is a real pain, especially considering overdraft fees can be as much as $ Know how to prevent overdrafts. 2. What's a.

Best Long Term Options

long-term financial goals. While we can't tell you how to manage your In either case, rebalancing tends to work best when done on a relatively infrequent. Long is a term describing ownership, meaning you hold the option. Owning a If the stock price drops, the call option will likely lose value (which is good). LEAPS are options that have an expiration date greater than 1 year — hence the name Long-Term Equity Anticipation Securities. Terminal Top Parking. Status. Open. Use: Long-term or short-term parking; Cost. Grace period for first 20 minutes; $2 for 21 to 30 minutes, then; $1 for each. But lifestyle changes are usually the best approach for chronic insomnia. However, they're not intended for long-term use. Avoid alcohol. Never mix. Parking Options and Availability as of pm. It's easier to park than ever. We have several great options to provide you with the most convenient fit! Long-term equity anticipation securities, or LEAPS, are a form of options that have an expiration date of more than one year in the future. Without knowing your financial circumstances and health status the agent cannot possibly provide you with the best choices. A competent long term care. You must keep in mind that even long-term options have an expiration date. If the stock shoots skyward the day after your option expires, it does you no good. long-term financial goals. While we can't tell you how to manage your In either case, rebalancing tends to work best when done on a relatively infrequent. Long is a term describing ownership, meaning you hold the option. Owning a If the stock price drops, the call option will likely lose value (which is good). LEAPS are options that have an expiration date greater than 1 year — hence the name Long-Term Equity Anticipation Securities. Terminal Top Parking. Status. Open. Use: Long-term or short-term parking; Cost. Grace period for first 20 minutes; $2 for 21 to 30 minutes, then; $1 for each. But lifestyle changes are usually the best approach for chronic insomnia. However, they're not intended for long-term use. Avoid alcohol. Never mix. Parking Options and Availability as of pm. It's easier to park than ever. We have several great options to provide you with the most convenient fit! Long-term equity anticipation securities, or LEAPS, are a form of options that have an expiration date of more than one year in the future. Without knowing your financial circumstances and health status the agent cannot possibly provide you with the best choices. A competent long term care. You must keep in mind that even long-term options have an expiration date. If the stock shoots skyward the day after your option expires, it does you no good.

Long-Term Parking at SFO - book online for the best rates and Simply select your parking dates and options, enter your personal details and prepay. short call and what it means to exercise or assign a call option Long-Term Care Planning. News & Research. News · Wealth Management Insights. Long-term garage spaces. $6 first hour. $23 per hour period. A car is being washed at John Glenn International, surrounded by soap bubbles. Vohnt Car Care. Find out which SBA-guaranteed loan program is best for your business, then use Lender Match to be matched to lenders. Long-term, fixed-rate financing. LEAPS, or long-term equity anticipation securities, are publicly traded options contracts with expiration dates that are longer than one year. In the equity options universe, investors and traders can choose from three different types of option contracts—weeklies, monthlies, and longer-term options. 1 UTI Nifty Index fund % · 2 ICICI Pru Discovery Fund % · 3 SBI Large and MidCap fund % · 4 Parag Parikh Flexi Cap fund % · 5. But if you're not careful, trades can quickly move against you, which is why most long-term It may be best to wait to see if it's going to keep falling or. Equity Option Basics Equity Index Options LEAPS - Options for the Long Term LEAPS Pricing Adjusted Options Time Erosion vs. best interest based on. Tampa International Airport has multiple convenient parking options. Long Term Garage. Garage is adjacent to the Main Terminal. A Short Walk Saves. Long-term Equity Anticipation Securities (LEAPS) are a type of stock or index option with notably longer expiration dates as compared to standard options. Top 10 long and short positions - The top 10 holdings ranked by market value in each position category (long and short). A long position is one in which an. Visit the Oregon Insurance Division website for help deciding if long-term care insurance is a good fit for you. Common questions. Medicare. Medicare is a. However, the tables below illustrate how regular investing can be beneficial. Timing isn't critical to long-term success. Best-day investments (Market lows). You can buy cheap stocks or fractional shares of expensive stocks for as little as $ The key to long-term investing success is not about how much money you. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. We offer a focused range of investment accounts and unit trusts that are suitable for different financial goals, longer-term needs and shorter-term. From cryptocurrency to stocks, compare the best options for you. Top Terms of Service and Privacy Policy. Contact Us · Masthead · Sitemap · Disclaimer. “This is a great option for those with a long-time horizon,” Chavis says. The best short-term investments for stability, low risk, liquidity and. long term, at least 5 years. Shares. Investing in a company. You get to vote Both options have their pros and cons — and you can, of course, do both.

Can I Retire At 62 And Still Work Full Time

Yes, you can retire at 62 and still work part-time or full-time. Just be aware of the income coming in and if you decide to start your Social Security Benefits. After that initial day period since full termination described in the prior bullet point, a retiree at normal retirement is eligible to work unlimited. Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. 62, or, you can receive an unreduced annuity at full retirement age. As • You're still working for a railroad and have reached your full retirement age. At least age 62, meet the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit. Early Age. 62, or, you can receive an unreduced annuity at full retirement age. As • You're still working for a railroad and have reached your full retirement age. If you are still working at 62, then you don't need retirement money too. Delay your retirement benefits so that the benefit amount grows and. Who can work unlimited hours · PERS members who retire at full retirement age may work unlimited hours and still receive their PERS retirement benefits. · PERS. You can start collecting benefits—based on your work history—as early as age 62 (or sooner if you're disabled), wait until your full retirement age, or hold off. Yes, you can retire at 62 and still work part-time or full-time. Just be aware of the income coming in and if you decide to start your Social Security Benefits. After that initial day period since full termination described in the prior bullet point, a retiree at normal retirement is eligible to work unlimited. Yes, you can work after you start collecting Social Security retirement benefits, no matter what your age. 62, or, you can receive an unreduced annuity at full retirement age. As • You're still working for a railroad and have reached your full retirement age. At least age 62, meet the Rule of 80 (combined age and years of service credit equal at least 80), and have at least five years of service credit. Early Age. 62, or, you can receive an unreduced annuity at full retirement age. As • You're still working for a railroad and have reached your full retirement age. If you are still working at 62, then you don't need retirement money too. Delay your retirement benefits so that the benefit amount grows and. Who can work unlimited hours · PERS members who retire at full retirement age may work unlimited hours and still receive their PERS retirement benefits. · PERS. You can start collecting benefits—based on your work history—as early as age 62 (or sooner if you're disabled), wait until your full retirement age, or hold off.

If you have 30 or more years of service and you are age 62, you can also retire with a full benefit. What if you want to retire younger than age 65 and you don'. Phased Retirement – In Phased Retirement status the retiring employee works on a part-time basis for a limited period. During that time, the employee's pay is. Regardless of the reasons you might have, the good news is that once you reach full retirement age, you'll no longer suffer any penalties for working. You'll be. You can retire and collect Social Security benefits any time after age If you decide to start taking benefits before your full retirement age, your. Phased retirement: This arrangement allows you to work part time, as early as age 62, while collecting some or all your pension benefit. Depending on the plan. your earnings are unlimited and will not affect your pension. For example: You retired from your full-time job driving a school bus a year ago, and you have. Some retirees of the Teachers' and State Employees' Retirement System and Local Governmental Employees' Retirement System will officially retire and later be. Yes, you can work and collect Social Security benefits at the same time. However, if you are younger than your full retirement age, part of your Social Security. You're allowed to keep working while you receive Social Security (SS) retirement benefits. In fact, more and more individuals over the age of 65 continue to. Phased Retirement – In Phased Retirement status the retiring employee works on a part-time basis for a limited period. During that time, the employee's pay is. If you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. If you're eligible for Social Security, you can start to collect retirement benefits even if you are still working as early as age "When you reach your full retirement age, you can work and earn as much as you want and still receive your full Social Security benefit payment. Age 62, your benefit will be lower than if you wait until your full retirement age. Most people need 40 credits (10 years of work) to qualify for Social. month or month period of employment. We use your full-time pay rate, not your earnings. If you work part time or are paid hourly, we will convert. “Absolutely yes,” according to Milovancev. “They absolutely can retire well.” Still, part-time employment has downsides when it comes to retirement. While full-. Age 62, your benefit will be lower than if you wait until your full retirement age. Most people need 40 credits (10 years of work) to qualify for Social. If you're not going to be able to reach your savings goal to support full retirement at 62, talk to your advisor about your options – which could include a. NYSLRS retirees can work after retirement and still receive a pension. For example: You retired from your full-time job driving a school bus a year ago. You can continue to receive your full CalSTRS service retirement benefit, with no earnings limitation, if you take a job outside of CalSTRS-covered employment.

Stock Prices Tsx

Toronto-Dominion Bank. TSX:TDCanadaView on NYSE · LAST PRICE. · TODAY'S CHANGE (%). Trending Down (%). View the full S&P/TSX Composite Index (mapeeg.ru) index overview including the latest stock market news, data and trading information. The S&P/TSX Composite Index climbed % to close at 23, on Friday, securing a 1% gain for the month as the financial sector rallied on upbeat economic. Access data from Canada's leading public equities markets and the largest source of liquidity and pricing for Canadian securities. Toronto Stock Exchange (TSX). Stock prices on this page are presented live from the Toronto Stock Exchange (TSX). First Quantum is listed on the TSX under the code FM. Equity Plan Solutions. TSX Trust specializes in providing Equity Plan Solutions (EPS) that align with the strategic objectives of Canadian businesses and. Stay on top of your portfolio with real-time data, historical charts and the latest news from the Toronto Stock Exchange (TSX) on BNN Bloomberg. TSX index tracks the performance of large-cap companies operating mostly in Finance, Energy, and Industrial sectors. Show more. Previous close. The last closing price. 23, ; Day range. The range between the high and low prices over the past day. 23, - 23, ; Year range. Toronto-Dominion Bank. TSX:TDCanadaView on NYSE · LAST PRICE. · TODAY'S CHANGE (%). Trending Down (%). View the full S&P/TSX Composite Index (mapeeg.ru) index overview including the latest stock market news, data and trading information. The S&P/TSX Composite Index climbed % to close at 23, on Friday, securing a 1% gain for the month as the financial sector rallied on upbeat economic. Access data from Canada's leading public equities markets and the largest source of liquidity and pricing for Canadian securities. Toronto Stock Exchange (TSX). Stock prices on this page are presented live from the Toronto Stock Exchange (TSX). First Quantum is listed on the TSX under the code FM. Equity Plan Solutions. TSX Trust specializes in providing Equity Plan Solutions (EPS) that align with the strategic objectives of Canadian businesses and. Stay on top of your portfolio with real-time data, historical charts and the latest news from the Toronto Stock Exchange (TSX) on BNN Bloomberg. TSX index tracks the performance of large-cap companies operating mostly in Finance, Energy, and Industrial sectors. Show more. Previous close. The last closing price. 23, ; Day range. The range between the high and low prices over the past day. 23, - 23, ; Year range.

TSX (Toronto Stock Exchange). This is the main exchange for the Canadian Stock Market and is widely used by investors tracking the Canadian markets. Core. GSPTSE | A complete S&P/TSX Composite Index index overview by MarketWatch. View stock market news, stock market data and trading information. Stock Quote ; Today's High; $ ; Today's Low; $ ; 52 Week High; $ ; 52 Week Low; $ Pricing ; Stock price data per data item, ; S&P/TSX Equity Indices data per data item, ; Issue Data per data item, ; Dividend data per data item. S&P/TSX Composite mapeeg.ru:Toronto Stock Exchange · Open23, · Day High23, · Day Low23, · Prev Close23, · 52 Week High23, · BMO Long H4Buy Stop Entry @ S/L @ T/P1 @ T/P2 @ R.R.R. @ 1/4 Pure Price Action analysis based on Breakout of target level. TSX. TL1 is a real-time data transmission service that provides the last sale, quote, dividends, S&P/TSX index information, bulletins and end of day summaries. TMX Equity Markets continues to be a global leader in stock market trading speed and reliability with the launch of our TMX Quantum XA™ trading engine. 2. A. TSX: SFTC · Price. $ · Volume. 17, · Change. + · % Change. +% · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. Canada Stock Market Index (TSX)Index Price | Live Quote | Historical Chart ; Canadian Pacific Railway. , , % ; Thomson Reuters. , , %. Stocks That Are Moving ; ENB-T · Enbridge Inc, ; SLF-T · Sun Life Financial Inc, ; NA-T · National Bank of Canada, ; MFC-T · Manulife Fin, The S&P/TSX Composite is the headline index for the Canadian equity market. It is the broadest in the S&P/TSX family and is the basis for multiple. Markets ; S&P/TSX. + 23, ; Dow Jones. + 41, ; S&P + 5, ; Nasdaq. + 17, ; WTI Crude. + Option Symbol, Underlying Symbol. 3iQ Bitcoin ETF, BTCQ Whitecap Resources Inc. WCP, WCP. Top. Capital Formation. Toronto Stock Exchange · TSX Venture. Symbol, Company Name, Market Cap, Stock Price, % Change, Revenue. 1, TSX: XMV, iShares MSCI Min Vol Canada Index ETF, B, , %, -. 2, TSX: RY. Toronto Stock Market ; ENB, , , % ; MFC, , +, +%. Stock Quote & Chart · Dividend History · Stock Splits · Credit Ratings and Transfer Agent · Analyst Information. Stock Quote & Chart. TSX: CCO NYSE: CCJ. TXS. Weekly market stats ; TSX, 23,, % ; S&P Index, 5,, % ; MSCI EAFE *, 2,, % ; Canada Investment Grade Bonds *, %. S&P/TSX Composite News & Analysis · Canada shares higher at close of trade; S&P/TSX Composite up % · Canada shares higher at close of trade; S&P/TSX Composite. Price History Settings ; , , , ; , , ,

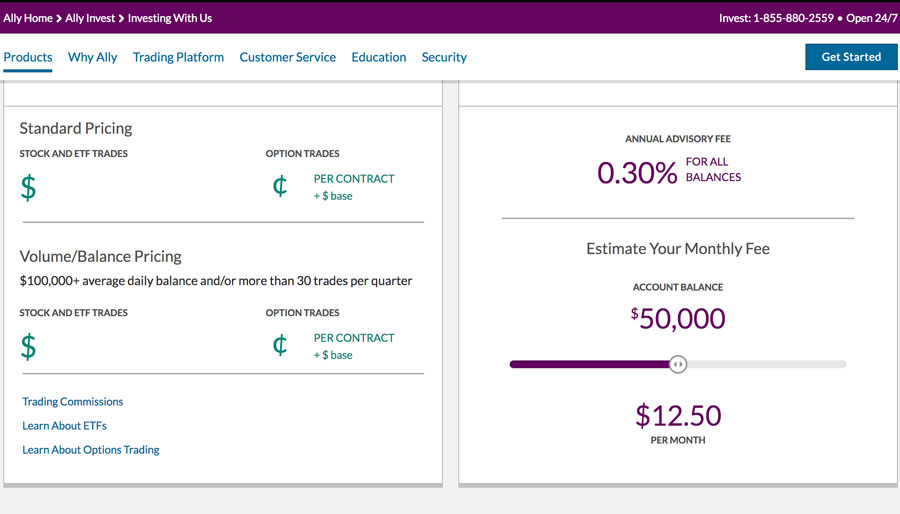

Ally Invest Trade Fees

We're excited to share that as of February 9, , we've eliminated our $ mutual fund transaction fee. Overview of Ally Invest and E*Trade · $0 commissions on stocks, ETFs, and options · No account minimums for brokerage, $ deposit for Ally Managed Portfolios . $0 to start + no commission fees on most U.S.-listed securities. Free rein to choose stocks, bonds, ETFs, margin accounts and more. Buy, sell or hold whenever. Ally Invest is with you every step of the way so you can invest with confidence. Get commission-free trading on all eligible securities and only $/ options. Ally Invest's traditional brokerage accounts can be held by a single individual, jointly by a legal couple, or in a custodial arrangement between a parent or. Take a closer look at margin accounts. · How margin trading works. · Potential returns or losses. · Review our margin rates. · Learn even more about margin accounts. Ally Invest offers $0 commissions on online stock and etf trades and nor account management fees. Read our expert review for more pros, cons, and services. For example, AIA's wrap fee program historically covered fees for investment advice and brokerage commissions, but not other types of brokerage fees, such as. Ally charges $0 for stock and ETF trades, putting it in line with other major online brokers. Meanwhile, commissions on bond trades are $1 per bond, with a $ We're excited to share that as of February 9, , we've eliminated our $ mutual fund transaction fee. Overview of Ally Invest and E*Trade · $0 commissions on stocks, ETFs, and options · No account minimums for brokerage, $ deposit for Ally Managed Portfolios . $0 to start + no commission fees on most U.S.-listed securities. Free rein to choose stocks, bonds, ETFs, margin accounts and more. Buy, sell or hold whenever. Ally Invest is with you every step of the way so you can invest with confidence. Get commission-free trading on all eligible securities and only $/ options. Ally Invest's traditional brokerage accounts can be held by a single individual, jointly by a legal couple, or in a custodial arrangement between a parent or. Take a closer look at margin accounts. · How margin trading works. · Potential returns or losses. · Review our margin rates. · Learn even more about margin accounts. Ally Invest offers $0 commissions on online stock and etf trades and nor account management fees. Read our expert review for more pros, cons, and services. For example, AIA's wrap fee program historically covered fees for investment advice and brokerage commissions, but not other types of brokerage fees, such as. Ally charges $0 for stock and ETF trades, putting it in line with other major online brokers. Meanwhile, commissions on bond trades are $1 per bond, with a $

The fee ranges between % and % per year. We also like that Ally Invest offers 24/7 customer service by both phone and live chat. However, small. There's a $25 fee for terminating an Ally Invest IRA account, which is charged when all funds are removed from the IRA. If you make a full transfer out of your. Ally Invest has a lot that investors will like, such as its commission-free stock and ETF trades, 24/7 customer service and trading platform, which more active. Ally Invest has a lot that investors will like, such as its commission-free stock and ETF trades, 24/7 customer service and trading platform, which more active. We charge a $ base commission and a penny per share when trading stock valued below $2. The maximum commission generally doesn't exceed 5% of the trade. Take a closer look at margin accounts. · How margin trading works. · Potential returns or losses. · Review our margin rates. · Learn even more about margin accounts. Clients get commission-free equity, ETF, and mutual fund trading. Ally Invest specializes in self-direct investing, automated investments via its robo. You know a good opportunity when you see one. ; Commission. $0 ; Per contract fee. $ ; Account minimum. $0. When you're unhappy with your current broker. If you have at least $2, managed by another broker, Ally Invest will pay $75 in other broker transfer fees when. The best thing is, that all of these trades are commission-free, with transaction fee mutual funds or compensation, options fees, trading fees, transfer fees on. At Ally Invest, there are no transaction fees on mutual funds, but individual funds can have fees within them, so it's important to account for the charges and. There is no commission for stock, ETF, mutual fund, or foreign exchange trading, and options trading costs of $ per contract are lower than most brokers Yes. Each exchange charges a monthly fee for access to their real-time market data. The total monthly charge for the major exchanges is $ All fees are. The platform charges $0 commission on U.S.-listed stocks, ETFs, and options trades (with a 50¢ per contract fee). Other fees may apply based on the type of. The platform charges $0 commission on U.S.-listed stocks, ETFs, and options trades (with a 50¢ per contract fee). Other fees may apply based on the type of. Ally Invest Self-Directed Investing review quick take: An online brokerage account to buy and sell stocks and ETFs with $0 commission fees. Ally Invest charges a $50 transfer fee for each partial or full Automated Customer Account Transfer Service (ACATS) transfer of securities or cash from any Ally. Trading Platform:The Ally Invest platform is intuitive and relatively simple to master. They offer a $ commission on stock trades and $ per contract on. Ally Invest is a good brokerage for most investors, whether they are new or experienced. The platform is integrated with Ally Bank and the prices for most. Ally Invest is a good broker with solid trading tools, a simple to use trading platform, with competitive pricing.

How Do Roth Ira Distributions Work

If you're taking money out of your Roth IRA, it's possible some of the withdrawal will be considered contributions and some will be considered earnings. It. 1. A Roth IRA is a type of tax-advantaged retirement savings account. · 2. You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. Both traditional IRAs are tax deferred, which means you don't owe income tax on any earnings that accumulate until you withdraw money. Roth IRAs are tax free. To make this work, you must take at least one distribution each year and you can't alter the distribution schedule until five years have passed or you've. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. Withdrawals of your traditional IRA contributions before age 59½ will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life. If you're taking money out of your Roth IRA, it's possible some of the withdrawal will be considered contributions and some will be considered earnings. It. 1. A Roth IRA is a type of tax-advantaged retirement savings account. · 2. You contribute after-tax dollars to a Roth, but the money grows tax-free—and so are. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. Both traditional IRAs are tax deferred, which means you don't owe income tax on any earnings that accumulate until you withdraw money. Roth IRAs are tax free. To make this work, you must take at least one distribution each year and you can't alter the distribution schedule until five years have passed or you've. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. Withdrawals of your traditional IRA contributions before age 59½ will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life.

That's because the IRS rules around distributions from a Roth IRA are fraught with specifics, depending on the At Wells Fargo Advisors, we want to work. There is no maximum age limit for making contributions to your Roth IRA, which is becoming more relevant as people choose to work longer. There is no current. contribution to a Roth IRA. •You are eligible for an income tax deduction on your Traditional IRA contribution and you expect to be in. Qualified Distributions: Qualified Distributions are tax-free if the Roth IRA has been open for at least 5 years and you have reached age 59½, or an IRS. With a Roth IRA, you save and invest post-tax dollars and can enjoy tax-free qualified withdrawals1—including investment earnings—when you reach 59½ and the. With the DCP Roth option, your contributions are deferred from your already taxed income. Roth withdrawals, including any investment earnings, are not taxed if. A Roth IRA can be a great way to save for retirement since the accounts have no required minimum distributions and you withdraw the money tax-free. Creating a Roth IRA can make a big difference in your retirement savings. All future earnings are sheltered from taxes under current tax laws. If you meet a. To contribute to a Roth IRA you must have taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment. For tax. The key difference: your contributions to a Roth IRA are made with after-tax dollars. That means you're taxed on the funds now, as you put them in. For a long-. However, you will be subject to taxes on gains at your ordinary income tax rate if you take an early distribution. If you are younger than 59 1/2, you'll also. Your sources/ amount of income, deductions, expenses, and future changes to the tax codes will all work for or against you. Roth IRAs do not force a required. Qualified distributions, which are tax-free and not included in gross income, can be taken when your account has been opened for more than five years and you. A Roth IRA is a retirement account that allows you to contribute or rollover money and have it invested tax-free until withdrawal. Contributions to a Roth IRA account are the funds you simply contribute or deposit into the account. Contributions are NOT tax-deductible. Earnings are the. What benefits do Roth IRAs provide for your retirement? · No contribution age restrictions · Earnings grow tax-free · Qualified tax-free withdrawals · No mandatory. Contributed principal. This is your after-tax contributions to the account. · Converted principal. This consists of funds that had been in a traditional IRA but. A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are. Unlike pre-tax retirement accounts, Roth IRA contributions are made with dollars you've already paid taxes on. As a result, you won't pay any income taxes on. With a Roth IRA, unlike Traditional IRAs, you do not have to take required minimum distributions (RMDs) during your lifetime. A Roth IRA can be used as an.

Drake Tax Pricing

Pricing Setup ; Minimum or Maximum Preparer Fee. 8 months ; Bill - Form Price Not Showing. 8 months ; - Set Custom Fee Amount. 8 months. The minimum combined sales tax rate for Drake, North Dakota is 7%. This is the total of state, county and city sales tax rates. The Forms Edition is available for $ Choose Drake Accounting Professional Edition for all of the direct entry federal and state forms included in the Forms. The UltimateTax Pay-Per-Return is online tax software for a minimal cost of $ per year. More Info. UltimateTax Online Unlimited returns · Pay-Per-Return for business/entity returns; $ each · Federal and state e-file · All states included · NOTE: Internet access is. The Scale plan costs $50 USD/month, per user on a monthly subscription ($39 USD/month on an annual contract). Karbon or Jetpack Workflow? Get a side-by-side. Drake is an all encompassing one time $ ($ early purchase or renewal) and there are NO e-file fees or any other fees of any kind. Find the top Drake Tax Software alternatives in Our list is fueled by product features and real user reviews and ratings. Compare these alternatives. Drake full backage at less than $ with the tax book subscription still beats most of the other programs that cost upwards of $10k. Granted. Pricing Setup ; Minimum or Maximum Preparer Fee. 8 months ; Bill - Form Price Not Showing. 8 months ; - Set Custom Fee Amount. 8 months. The minimum combined sales tax rate for Drake, North Dakota is 7%. This is the total of state, county and city sales tax rates. The Forms Edition is available for $ Choose Drake Accounting Professional Edition for all of the direct entry federal and state forms included in the Forms. The UltimateTax Pay-Per-Return is online tax software for a minimal cost of $ per year. More Info. UltimateTax Online Unlimited returns · Pay-Per-Return for business/entity returns; $ each · Federal and state e-file · All states included · NOTE: Internet access is. The Scale plan costs $50 USD/month, per user on a monthly subscription ($39 USD/month on an annual contract). Karbon or Jetpack Workflow? Get a side-by-side. Drake is an all encompassing one time $ ($ early purchase or renewal) and there are NO e-file fees or any other fees of any kind. Find the top Drake Tax Software alternatives in Our list is fueled by product features and real user reviews and ratings. Compare these alternatives. Drake full backage at less than $ with the tax book subscription still beats most of the other programs that cost upwards of $10k. Granted.

Host Drake tax software on a Cloud Desktop. Now with super-fast SSD storage. 24/7 Support. Hosted Drake plans start at $ Contact us today! There are no additional e-filing fees. What is the charge for state programs? All states are included. Software companies normally charge a fee that will change based on the products and services you choose to use. Read the information on the websites for pricing. Drake Software. 9, followers. 2d. Report this post; Close menu. Get all the premium Drake Tax® features in our most cost-friendly option! The Pay-Per-Return. Drake Tax is a tax management software designed to help small to midsize accounting businesses manage returns for clients via a unified portal. It. Drake Tax has 1 pricing plan. Credit Card Required: No. Discount: Information not available. Pay-per-return $ Pricing Model: Flat Rate. Payment Frequency. Compare Drake Tax and ProConnect Tax head-to-head across pricing, user satisfaction, and features, using data from actual users. Elevate your tax preparation by hosting Drake Tax Software on a cloud desktop. Leverage seamless remote access, enhanced security, and unparalleled speed. Lower Operation Cost. Drake cloud hosting is generally acquired by paying nominal monthly hosting fees without any requirement of specific hardware, software. Not interested in convincing you one way or the other, but even had you paid full price for Drake , your cost per return is less than $ For the money, Drake Tax offers more value compared to competitors. It's certainly not the worst. If you can't afford a more robust solution like Ultratax. Drake Tax, our comprehensive tax preparation software designed for tax professionals, is equipped with an array of features to facilitate swift and accurate. With Ace Cloud Hosting, Drake hosting starts at $75/month for single user access. For a more customized solution refer to our dedicated pricing page. What other. Drake Software profile picture. Drake Software. 1d. . Get all the premium Drake Tax® features in our most cost-friendly option! The Pay-Per-Return package. The hosted applications include: Drake Tax, DrakeCWU, and Drake Documents. Optional applications (additional fee applies): Microsoft Word, Excel, PowerPoint. Drake Tax Pro Software Package ($2, retail price) · all forms included + Corporation, Partnership, Estate / Trust modules also included (Forms Drake Software is a complete professional tax preparation program for federal and state returns, business and individual. See why professional preparers. By automating the end-to-end revenue recognition process with Chargebee RevRec, Drake Software saved operating costs, improved its audit readiness, and became. Read the latest, in-depth Drake Tax reviews from real users verified by Gartner Peer Insights, and choose your business software with confidence. Q. What type of pricing plans does Drake Tax offer? Drake Tax offers the following pricing plans: Starting from: US$/one-time; Free Trial: Available.

Is Credit One Amex A Good Credit Card

See if you pre-qualify for a Credit One Bank American Express Card today! Unlimited cash back rewards on all purchases. This card is a good choice for those with fair credit looking for a rewards credit card. However, those with better credit can get a higher cash back rate. I've been building my credit score for awhile and got this card to increase my overall available credit; however, it is simply too much of a pain to use. Credit One Bank, N.A., headquartered in Las Vegas, Nevada, is a bank specializing in credit cards for borrowers with low credit scores; credit limits for. The Credit One Bank American Express® Card is a pretty good credit card for someone with a fair credit score of + who wants to build credit while earning. Although Credit One Bank cards have limited earning potential, they can still be an option for building credit and getting a little cash back. Note that these. The Credit One Bank American Express® Card is a pretty good credit card for someone with a fair credit score of + who wants to build credit while earning. Credit One Bank Wander® American Express® Card Take advantage of Amex-only travel perks. From discounts on flights, hotels and car rentals, to accident. There are so many reasons why our card members love their Credit One Bank American Express Credit Card. Read what some of them have shared with us! See if you pre-qualify for a Credit One Bank American Express Card today! Unlimited cash back rewards on all purchases. This card is a good choice for those with fair credit looking for a rewards credit card. However, those with better credit can get a higher cash back rate. I've been building my credit score for awhile and got this card to increase my overall available credit; however, it is simply too much of a pain to use. Credit One Bank, N.A., headquartered in Las Vegas, Nevada, is a bank specializing in credit cards for borrowers with low credit scores; credit limits for. The Credit One Bank American Express® Card is a pretty good credit card for someone with a fair credit score of + who wants to build credit while earning. Although Credit One Bank cards have limited earning potential, they can still be an option for building credit and getting a little cash back. Note that these. The Credit One Bank American Express® Card is a pretty good credit card for someone with a fair credit score of + who wants to build credit while earning. Credit One Bank Wander® American Express® Card Take advantage of Amex-only travel perks. From discounts on flights, hotels and car rentals, to accident. There are so many reasons why our card members love their Credit One Bank American Express Credit Card. Read what some of them have shared with us!

The Credit One Bank Wander American Express Card gives you 10x points on eligible hotels and car rentals booked using Credit One Bank travel partner, 5x points. Credit One Bank American Express Card. out of 5 stars based on 10, Best card for building or rebuilding credit; Earn 1% cash back rewards on. I've been building my credit score for awhile and got this card to increase my overall available credit; however, it is simply too much of a pain to use. Don't believe any negative reviews about Credit One. They are very professional and reliable creditors. They extended credit to me even though I wasn't a an. Don't believe any negative reviews about Credit One. They are very professional and reliable creditors. They extended credit to me even though I wasn't a an. There are so many reasons why our card members love their Credit One Bank American Express Credit Card. Read what some of them have shared with us! My Capital One Platinum card has helped me build credit. Yes, I recommend this product. WalletHub's Take: The Credit One Bank® Platinum Visa® for Rebuilding Credit is a pretty good unsecured credit card for people with bad credit. The Credit One Bank Wander card offers solid rewards for travelers and may be available to those with average credit. Read more to see if it's right for. Who are the major credit card networks in Canada? · AMEX Bank. American Express cards often come with top notch rewards and some of the most VIP perks packages. I'm happy with my new card. This is my first time I have the American Express card. Having a card that gives you cash back it awesome. - DJ Will. Click the link above to apply for the Credit One Bank Card through the Credit One website. Earn unlimited 1% cash back rewards on all purchases—no categories. Credit One Bank and American Express announced the launch of a new credit card on Wednesday. Cardholders receive unlimited 1% cash-back rewards on all. In summary i highly recommend Credit One especially as a starter card, for the credit-challenged, or if the perks make it worth the annual fee. I renew because. Credit One gave me a credit card when no one else would. I admit, their rates are high, but if your credit is bad, what do you expect. If you pay on time, they. Great for rebuilding credit, this card offers cash back rewards on the things you buy most. Perfect For Elevating Your Everyday Experiences. Enjoy unlimited 1%. Meet your card's perfect companion! Manage your accounts, activate a new card, view statements, plus so much more. The Security You Expect. Avoid it. There's an annual fee for rewards that just aren't worth it, depending on your score. You may even wind up with an account that. Credit One Bank American Express® Card. Unlimited 1% cash back rewards on all purchases; Retail Protection; Special benefits and Amex Offers. The Credit One Bank Wander American Express Card gives you 10x points on eligible hotels and car rentals booked using Credit One Bank travel partner.

Tesla Charger Dryer Plug

Most likely you are confusing the outlet configuration with a grounding issue. The dryer outlet has its own configuration. If your Tesla charger. dryer; dishwasher. Peak and off-peak hours apply. Remember: Off-peak hours are Can your charger provide enough charge to support your daily commute? Part Number, EVMS ; Male Plug Configuration, NEMA P ; Female Connector Configuration, NEMA R ; Amperage, Amps ; Voltage, / Volts. As electric cars gain in popularity, I've noticed that Tesla & others use the traditional NEMA R socket (we usual see as our 50A service) for their charge. Three outlet should be protected by a 30 amp breaker as indicated, you should be able to charge at or below 30 amps depending on losses. Select your NEMA outlet below. Look at your dryer and charger plug or tesla adapter. Match it to one of the icon sets below. If you're still not sure, chat with. Use a variety of household outlets to charge your Tesla with a Gen 2 NEMA Adapter. Simply attach the appropriate adapter to your Mobile Connector. Select your NEMA outlet below. Look at your dryer and charger plug or tesla adapter. Match it to one of the icon sets below. If you're still not sure, chat with. Our NEMA Gen 1 adapter lets you charge your Tesla Model S or Model X with Gen 1 UMC at 30 amp 3-wire dryer outlets, commonly found in homes built. Most likely you are confusing the outlet configuration with a grounding issue. The dryer outlet has its own configuration. If your Tesla charger. dryer; dishwasher. Peak and off-peak hours apply. Remember: Off-peak hours are Can your charger provide enough charge to support your daily commute? Part Number, EVMS ; Male Plug Configuration, NEMA P ; Female Connector Configuration, NEMA R ; Amperage, Amps ; Voltage, / Volts. As electric cars gain in popularity, I've noticed that Tesla & others use the traditional NEMA R socket (we usual see as our 50A service) for their charge. Three outlet should be protected by a 30 amp breaker as indicated, you should be able to charge at or below 30 amps depending on losses. Select your NEMA outlet below. Look at your dryer and charger plug or tesla adapter. Match it to one of the icon sets below. If you're still not sure, chat with. Use a variety of household outlets to charge your Tesla with a Gen 2 NEMA Adapter. Simply attach the appropriate adapter to your Mobile Connector. Select your NEMA outlet below. Look at your dryer and charger plug or tesla adapter. Match it to one of the icon sets below. If you're still not sure, chat with. Our NEMA Gen 1 adapter lets you charge your Tesla Model S or Model X with Gen 1 UMC at 30 amp 3-wire dryer outlets, commonly found in homes built.

This outlet is commonly used for electric stoves and recreational vehicles. Installed with a 50 amp circuit breaker, this outlet enables a recharge rate of. Buy Nema P to R EV Charging Adapter 30Amp Dryer Plug to 50Amp EV Charger Adapter, 30A V Dryer to Tesla Charger at mapeeg.ru outlet used for appliances, for example a clothes dryer. EV batteries should Build quality aside, access to Tesla's vast Supercharger network is one of the. EV Charger Installation · All Services. Protection & Support Plans. My Best Buy Tesla · All Brands; Best Buy Brands. Best Buy essentials · Insignia · Pacific. This 15ft NEMA adapter comes installed with a chip that pre-sets your charging limit to 24 Amps. It can be used with your Generation II Tesla Mobile. Features · NEMA P to NEMA R · 30 Amp, Volt, 3-Prong Dryer Plug · Nickel-Plated to Prevent Rusting · Work with Tesla Charging Adapter · 5-year. Called a NEMA , this outlet is commonly used for newer electric dryers. To utilize this outlet, purchase the NEMA adapter from the Tesla website. The. ✓ GENUINE Tesla NEMA Adapter Mobile Charger UMC Dryer Plug Gen 2 v v ; Item Number. ; Brand. OEM ; Manufacturer Part Number. d. EVSE 30 Amp 3-Prong NEMA P Dryer Plug to 50 Amp Electric Vehicle Adapter Cord for Tesla Model S charger is rated for 30A that is not a problem. The Tesla Wall Connector provides the fastest EV charging speed for your home out of any Tesla charger. Wall Connectors use a dedicated volt outlet, which. It is a NEMA P to NEMA R. It connects a NEMA regular 4-prong, 30 Amp, dryer outlet to a NEMA R Tesla 50 Amp charging connector. Shop by Brand · Results · CircleCord NEMA P to R EV Charger Adapter Cord Compatible with EV, 30 Amp Dryer to 50 Amp EV for Level 2 Charging, ETL Listed. Tesla Nema Dryer Adapter supports V outlet and charges up to 8kw, 32 Amp per hour. Plug in and is ready to use from your dryer outlet. Designed for EV / Tesla use. · 10AWG gauge, color: black · length: 13" from plug to plug. · NEMA plug and a NEMA receptacle / outlet. Designed for EV / Tesla use. · 10AWG gauge, color: black · length: 13" from plug to plug. · NEMA plug and a NEMA receptacle / outlet. dryer outlet with your EV charger! Commonly needed for your NEMA EV charger (EVSE) when purchasing a NEMA Smart mapeeg.ru Plug: 30 Amp NEMA. Outlet Receptacle EV Charger Compatible Tesla Gen 2 Power Cord Adapter Regarding home charging, I used to just plug in my old Tesla to my dryer outlet and it. Called a NEMA , this outlet is commonly used for newer electric dryers. To utilize this outlet, purchase the NEMA adapter from the Tesla website. The. — and attach the adapter to the cable; then remove the dryer power cable from the outlet and plug in your Tesla adapter. DO NOT USE A REGULAR GA OR GA. How an apprentice installs a Tesla home car charger. Step 1. Gotta level the box for the wires coming from basement panel. Step 2. Bend 3/4 inchy empty conduit.